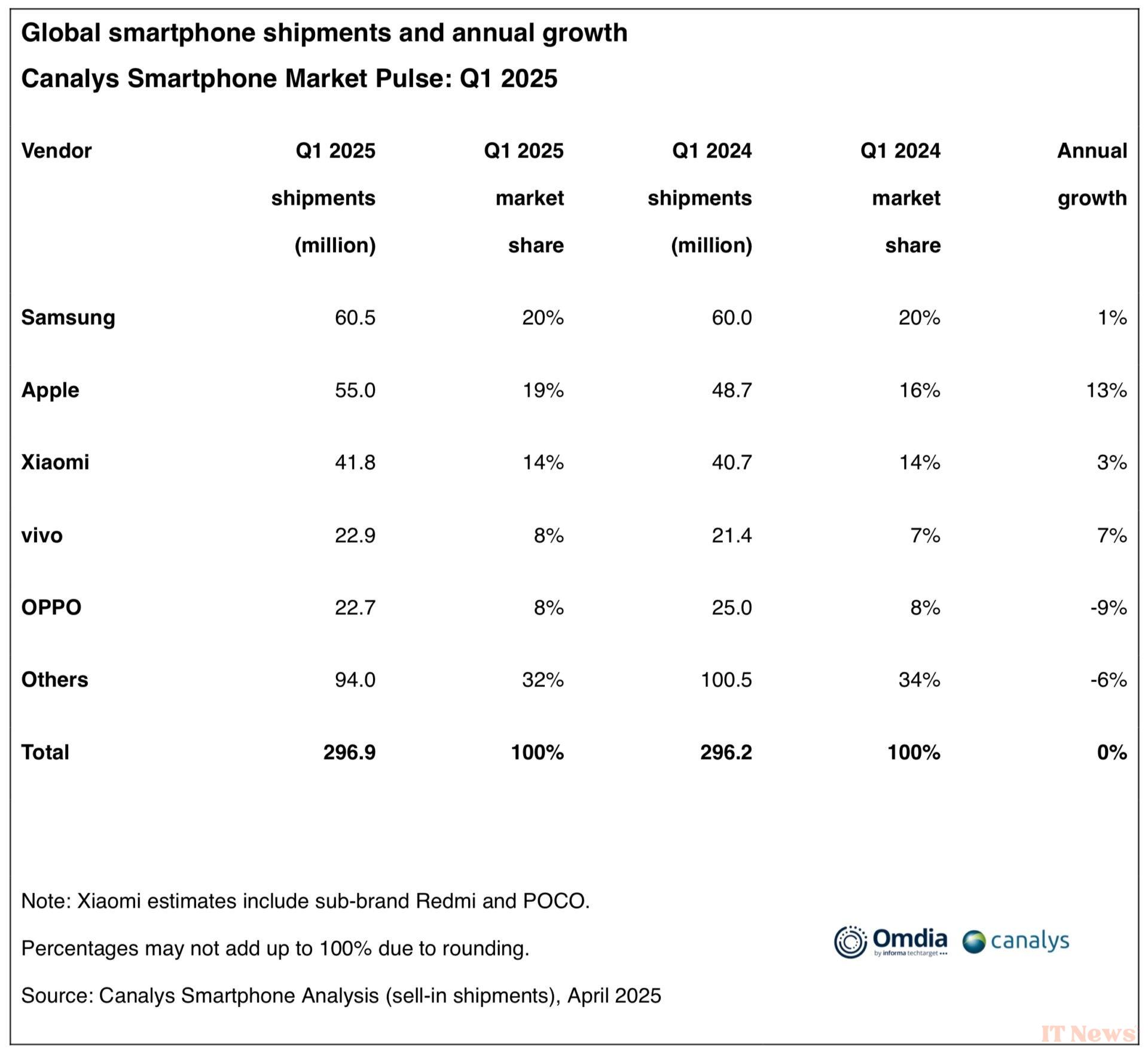

In many ways, the first quarter of 2025 was exceptional for smartphone manufacturers. Not so much in terms of volumes, since according to the Canalys survey, shipment growth was almost zero (+0.2%, with almost 297 million units delivered). But rather by Donald Trump's announcement of customs duties in early April, an event that the American president had been telegraphing for weeks.

Apple fills its warehouses with iPhones

And this allowed manufacturers to take precautions. This is the case for Apple, which brought numerous pallets of iPhones to the United States in anticipation of the shock. The manufacturer thus posted a 13% growth in overall shipments, with 55 million units. "The US smartphone market stood out, with 12% year-on-year growth in the first quarter, mainly driven by Apple," Canalys explains.

iPhones produced in China still account for the majority of shipments to the United States, but Indian volumes have increased: production there has accelerated, covering the iPhone 15 and 16. The pace for the Pro models, which are more complex to assemble, has also increased. Donald Trump finally suspended the application of his "tariffs" on smartphone imports—although things could change tomorrow or next week, who knows.

But Apple also played a wild card that clearly attracted many consumers at the start of the year: the iPhone 16. The growth recorded in the first quarter is therefore not solely a technical circumstance.

Despite this performance, Apple remains second in the market with 19% (still 3 points more than last year). Samsung is ahead with 60.5 million units (+1%), for a market share of 20%. The Korean manufacturer was able to rely on the Galaxy S25 and especially the mid-range Galaxy A, which are still very popular. Xiaomi is third in the ranking with 41.8 million units shipped (+3%, or 14% of the market).

Canalys indicates that customs duties will have a greater impact on entry-level/mid-range models, which is logical: devices in this category are sold with lower margins. Consequently, we should expect an increase in the average selling price in the United States. "These dynamics create new uncertainties, not only for Apple, but also for competing Android brands. Pricing strategies, carrier bundles, and future product lines will be under significant pressure,” the analyst firm adds.

Until the end of the year, the US smartphone market is more than certain to experience significant shocks due to inventory adjustments and “eroding consumer confidence.”

Source: Canalys

0 Comments