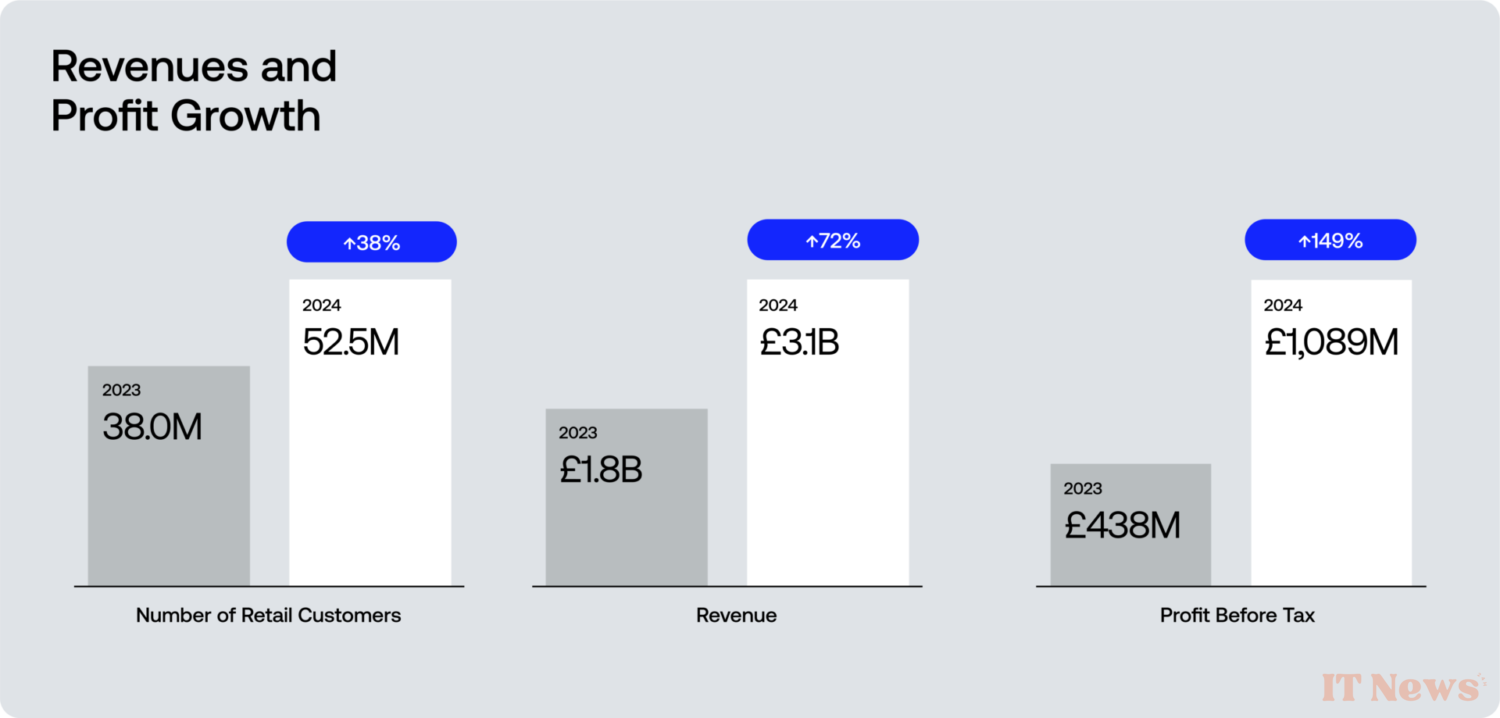

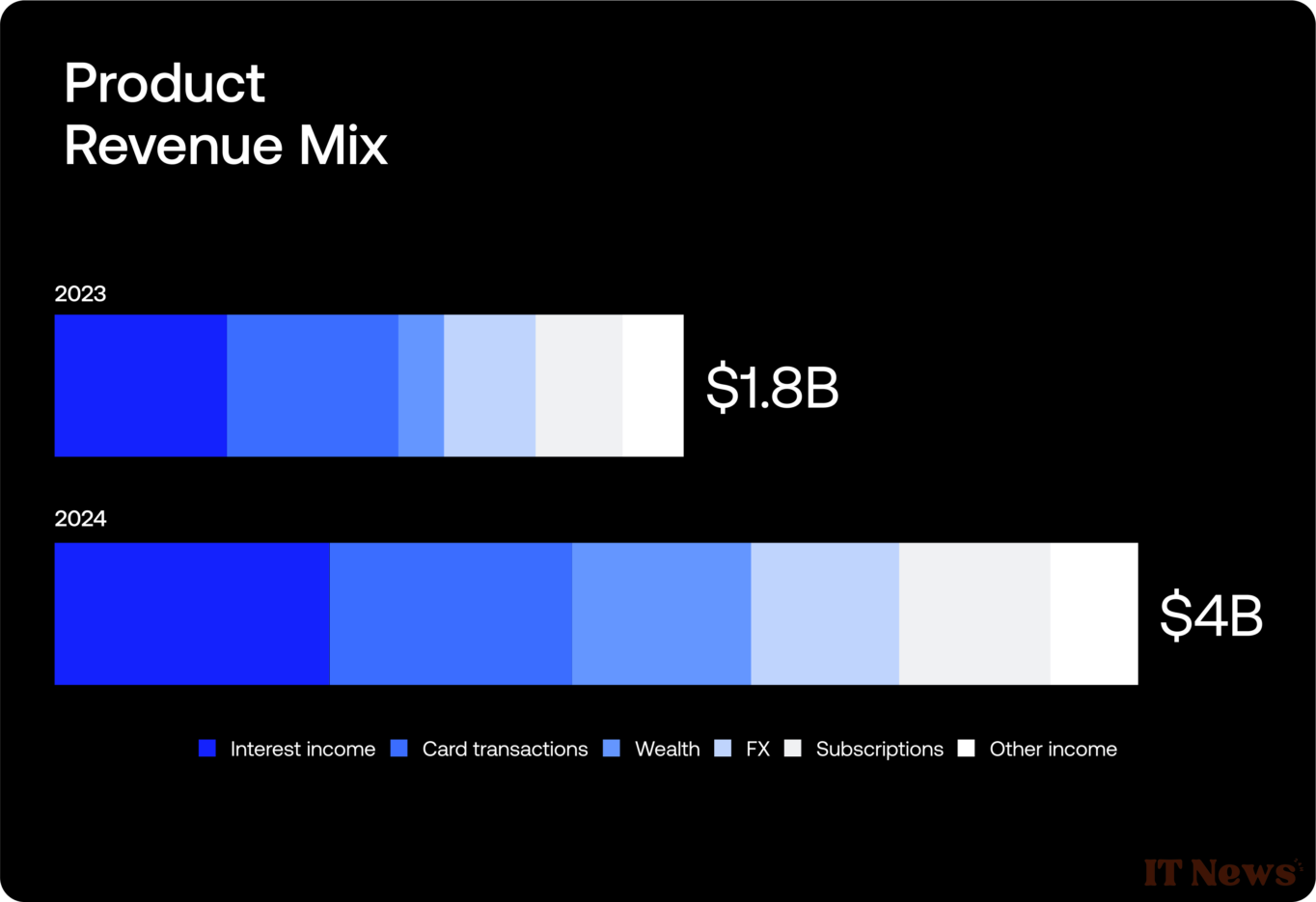

Barely two decades after the birth of the modern neobank, Revolut has established itself as one of the undisputed champions of the global financial sector. The British unicorn, which started as a simple low-cost foreign exchange app, now boasts a pre-tax profit of $1.4 billion and a turnover up 72%, reaching $4 billion!

The year 2024 marks the fourth consecutive year of profitability for FinTech, which has capitalized on a strategy combining product diversification, international expansion, and powerful technological support.

An exploding customer base, with France at the forefront

Revolut is no longer just a travel app or an alternative to traditional banks. In 2024, 15 million new users joined the platform, bringing the total to 52.5 million customers worldwide. France, in particular, is establishing itself as a key market: more than a million new customers have been recruited there, and France is becoming the second largest market global brand, with more than 5 million users.

The Revolut phenomenon affects all generations: the Revolut <18 segment, aimed at the youngest, jumped by 121%, while the adoption of joint accounts was multiplied by 3.6 in one year.

Services increasingly used

If Revolut is attractive, it is also because its services are convincing. The volume of transactions has climbed by 52% in one year, reaching $1.3 trillion, and the use of premium features is exploding: paid subscriptions have increased by 94% in France. The RevPoints loyalty program, launched in the summer of 2024, attracted 6.6 million users in just a few months.

The professional segment is not left out: Revolut Business sees its revenues climb to $592 million, now representing 15% of global revenue.

Soaring revenues on all fronts

Revolut's offering has significantly expanded, and the figures confirm it. The Wealth segment (wealth management) jumped by 298%, subscription revenue by 74%, and interest-related earnings reached $1 billion. Even deposits are exploding: €36 billion in customer balances at end of 2024, up 66%, including 3.2 billion deposited in France, representing growth of 103% over one year.

But Revolut does not intend to slow down. 2025 is already looking as a year of consolidation and expansion: opening the bank in the United Kingdom, launching in Mexico, applying for licenses in more than 10 countries, and imminent arrival on the Indian market. With a clear objective in sight: to reach 100 million daily active users in 100 countries!

0 Comments