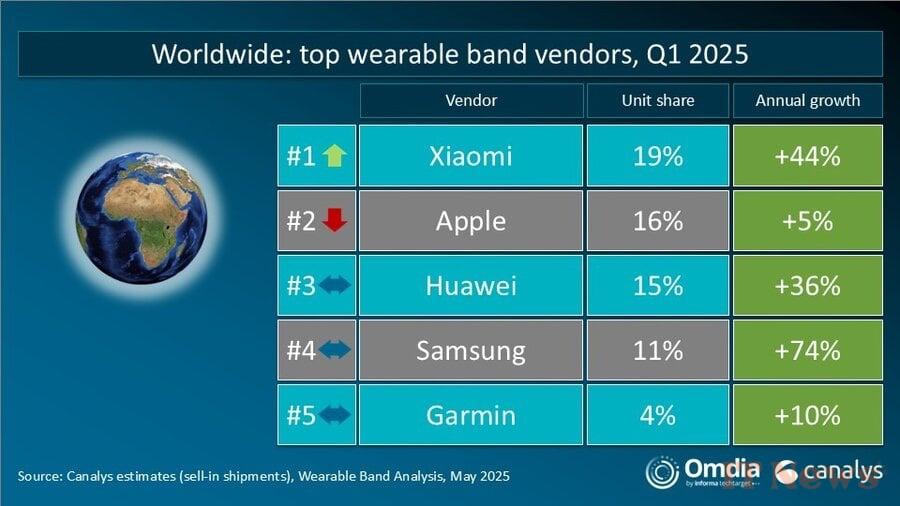

Xiaomi was the undisputed master of wearables in the first quarter, snatching first place from Apple according to Canalys data. However, it's important to put things into perspective: these figures apply to both smartwatches and wristbands, a product segment in which Apple is absent.

Price, the main criterion for buyers

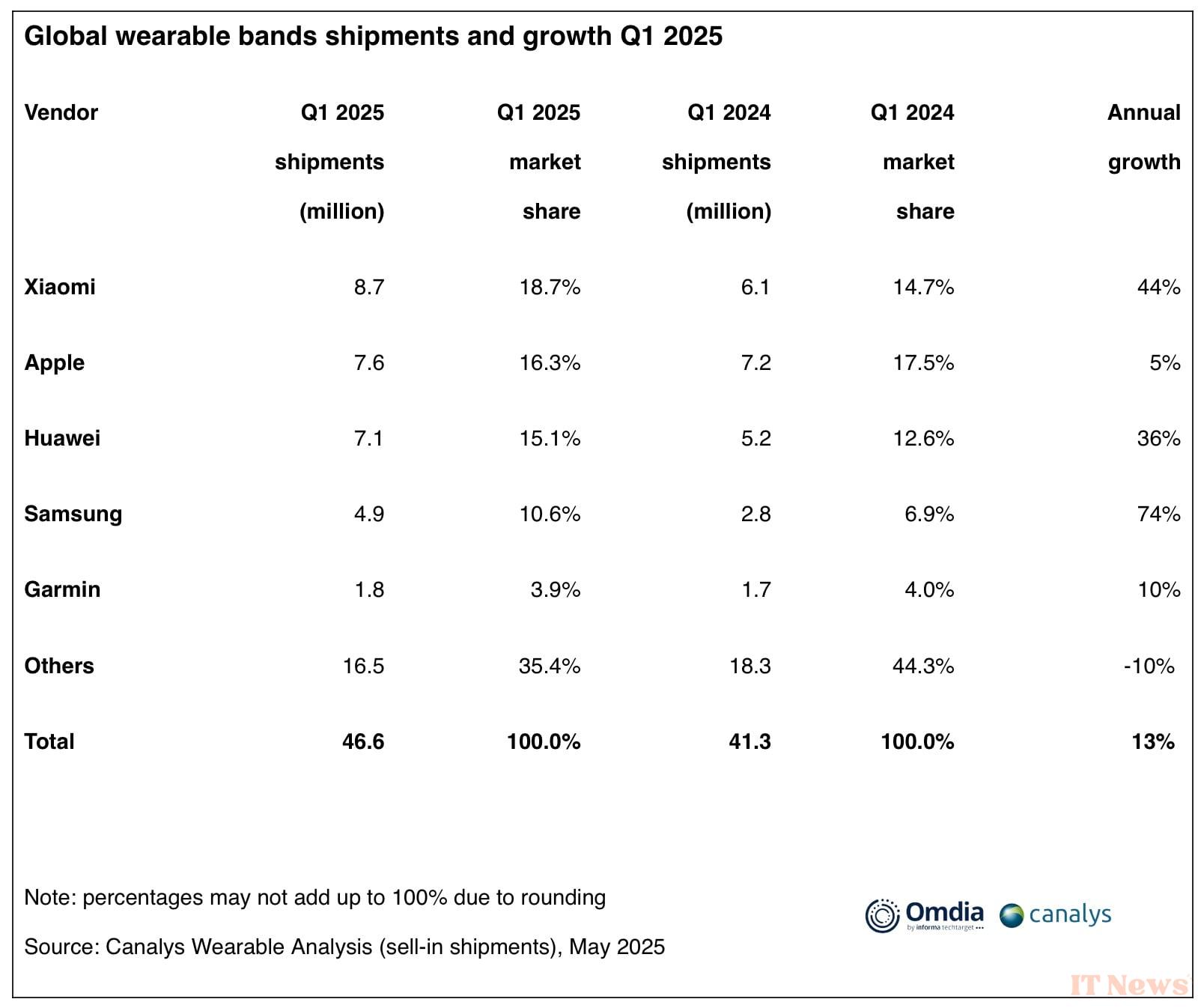

Apple had a solid first quarter, with a 5% increase in Apple Watch shipments. But that wasn't enough to slow down the crazy Xiaomi train, which posted 44% growth compared to last year and a 19% market share—3 points more than Apple. In doing so, Xiaomi regains the first place it had already achieved in the second quarter of 2021.

The Chinese giant has refreshed its Mi Band (bracelets) and Redmi Watch (watches) ranges, with new designs and additional data management functions. These products are much more affordable than the Apple Watch. In terms of volumes, Xiaomi shipped 8.7 million units in the first quarter, compared to 7.6 million Apple Watches.

Apple could regain its throne later this year, with the launch of new models expected for the fall. The 2024 vintage wasn't fantastic: the Apple Watch Series 10 simply helped limit the damage in the absence of the new Apple Watch SE and Apple Watch Ultra.

In the rest of the ranking, Huawei remains in third place with 15% of the market and, above all, a 36% increase in shipments (7.1 million units). The GT and Fit ranges performed well, and the manufacturer expanded the rollout of its Huawei Health app. Samsung enjoyed the strongest growth in shipments: +74%, with 4.9 million units and 11% of the market.

Garmin, the "historic" player in the market, is fifth with a 10% growth in shipments (1.8 million units) and 4% of the market. The company launched a paid Connect+ subscription at the end of March.

The general lesson from the start of this year is that the wearables sector is completing its shift from a hardware-centric model to one based on the ecosystem and services. Manufacturers are developing platforms and services to generate recurring revenues to offset the decline in hardware profitability.

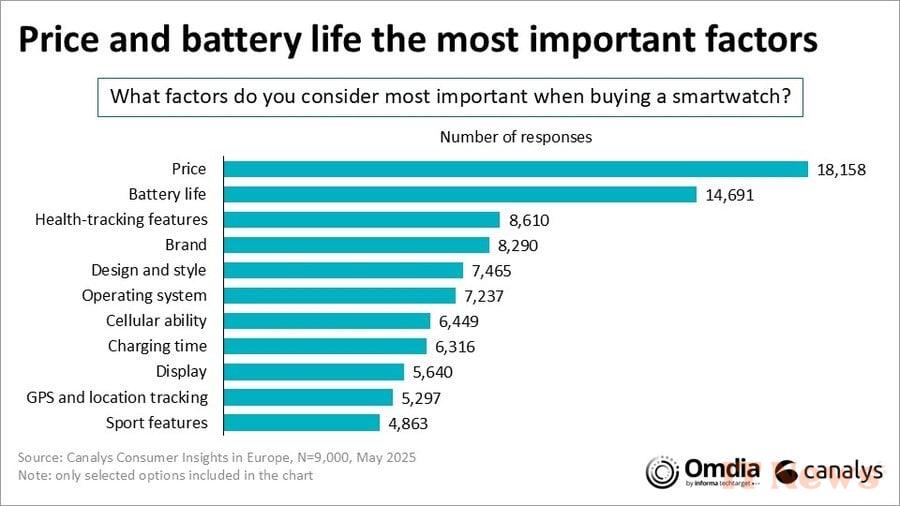

Price is also a key issue: it was the top criterion in a Canalys survey in Europe. Battery life came in second, followed (but by a long way) by health monitoring features. Price is where Apple struggles...

Source: Canalys

0 Comments