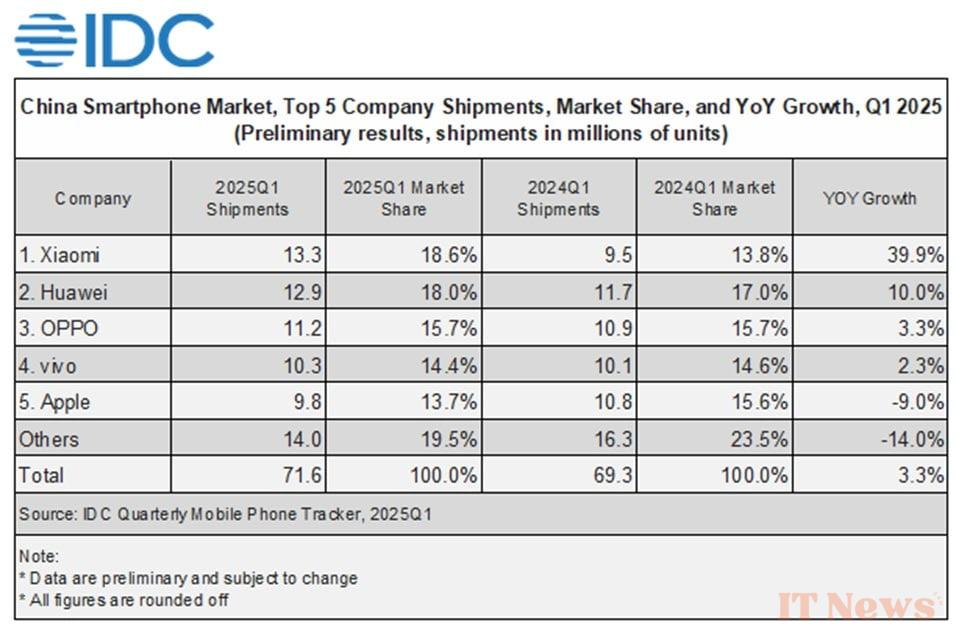

iPhones are struggling in one crucial market: China. While the Chinese smartphone market is expected to grow 3.3% year-over-year in the first quarter of 2025, iPhone sales are falling. According to data from analyst firm IDC, iPhone shipments in China fell 9% in the first three months of the year, from 10.8 million units in 2024 to 9.8 million this year. This notable decline relegates Apple to fifth place in the manufacturer ranking, behind local giants Xiaomi (13.3 million units shipped), Huawei (12.9 million), Oppo (11.2 million) and Vivo (10.3 million).

The Cupertino company's market share logically follows this negative trend, falling to 13.7% compared to 15.6% a year earlier. Apple is the only manufacturer in the Chinese top 5 to see its sales decrease over this period, unable to keep up with the pace set by Xiaomi and Huawei. The two giants saw their market share increase significantly, reaching 18.6% and 18% respectively. In third place, OPPO also progresses to keep vivo off the podium.

Donald Trump is not responsible for all of Apple's problems in China

With the American giant's difficulties in China, attention is inevitably turning to Donald Trump and geopolitical tensions. The ongoing trade tensions between the United States and China create a climate of uncertainty, but IDC analysts also point to other factors to explain Apple's difficulties. Will Wong, research manager at IDC Asia/Pacific, notes that "Apple's high-end pricing structure has prevented it from to capitalize on subsidies». Even the launch of the more affordable iPhone 16 wasn't enough.

Indeed, the Chinese government implemented subsidies in early 2025 to stimulate the market, but these primarily targeted entry-level and mid-range devices. iPhones, positioned in the premium segment, were therefore unable to benefit from this boost. Conversely, brands like Xiaomi took full advantage of of this policy and the manufacturer even regains first place, a first in almost ten years.

The absence of Apple Intelligence, an additional handicap?

Another element could work against Apple: the notable absence of Apple Intelligence, the suite of features based on artificial intelligence, on iPhones sold in China. As reported by the website 9to5Mac, Tim Cook, Apple's CEO, himself acknowledged in January that iPhone sales were more dynamic in countries where these innovations were already deployed.

While Apple still dominated in China at the end of 2023, the Apple brand was dethroned by several local manufacturers. This poor performance comes in a market Chinese market growth (+3.3%, with 71.6 million units shipped). Growth even exceeds that of the global market (+1.5%), a dynamic driven by subsidies and the sales peak linked to the Lunar New Year.

However, IDC warns that challenges remain for the entire sector. Sino-US tensions could lead to "rising costs and tightening consumer budgets," threatening future growth.

0 Comments