The expression "cash cow" has never been so apt for Apple's services. Between January and the end of March, this business generated $26.6 billion in revenue; it's the manufacturer's second-largest revenue source, behind the iPhone ($46.8 billion), but well ahead of everything else.

Apple on the defensive

Adding up revenue from the Mac ($7.9 billion), the iPad ($6.4 billion), and all the "wearables" like the Apple Watch and accessories ($7.5 billion) doesn't even come close to matching services! And Apple has every incentive to sell services: the company actually achieves a gross margin of 75.7% on this business. There are very few businesses (legal ones, that is) that boast such a margin!

Of these 26.6 billion, Apple's costs are only 6.4 billion. To put it another way: for every euro spent by a subscriber to Apple services, approximately 75 cents ends up directly in the pockets of the American giant. The gross margin on hardware is 35.9%, which is already rather comfortable. On average, Apple's gross margin is 47.1% on all its products and services.

Be careful, however, this assertion must be qualified: the gross margin does not take into account indirect costs (research, marketing, overhead, litigation, etc.). It therefore does not correspond to net profit. However, we imagine that at the end of the day, the net margin must be comfortable.

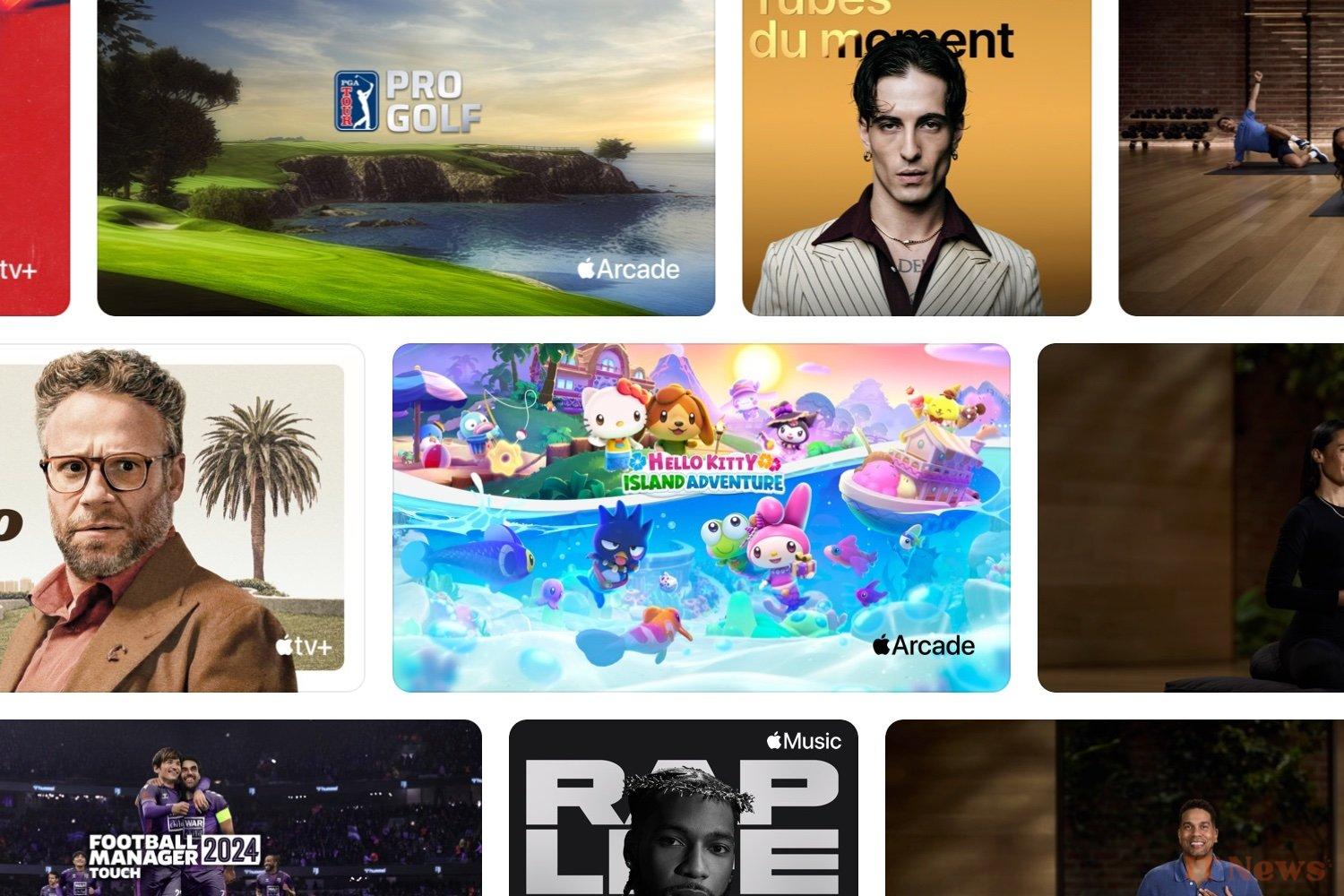

What are we talking about? Apple's services are a mishmash of activities that ultimately share very little in common. Obviously, this category includes Apple Music, Apple TV+, Fitness+, News+, Apple Arcade, Apple Books and Podcasts, which are very mainstream services. Let's add to the basket Apple Pay (which allows Apple to take a small commission on each transaction), Apple Card, and Cash.

But the services also include iCloud+ and its paid storage, which is quickly necessary beyond the 5GB of storage generously offered by Apple, Apple Care guarantees, the Apple One subscription pack, as well as the juicy commissions from the App Store and Google's check for being the default search engine for Safari.

Given the stratospheric level of its gross margin, it's easy to understand why Apple is trying to defend its services tooth and nail in court and against regulators.

The App Store and Google's check are being battered from all sides. The American justice system could demand that Google stop its payments to Apple to put an end to the web giant's abuse of its position in online search. We're not talking about three francs six cents: in 2022, Google paid Apple a whopping $20 billion, for ultimately very little effort.

This explains why the computer manufacturer wanted to defend Google during the trial (currently taking place) that will determine the remedies for the search engine's abuse of dominant position.

It also poses a very serious threat to App Store commissions. By court order, Apple has finally given in by allowing developers to display their offers outside the App Store. In Europe, the DMA is forcing Apple to make concessions—not enough, given the fine recently imposed for violating the law. But all this bodes well for trouble for the services cash register.

The latter recorded an 11.6% increase in revenue in the first quarter compared to last year. Impressive double-digit growth... even though the financial analyst consensus was aiming for more!

Source: 9to5Mac

0 Comments