The smartphone market is most often viewed through the prism of specific models. But sometimes it's worth taking a step back. This is what the latest Canalys report allows, which takes stock of the trends observed in Europe in the first quarter of 2025.

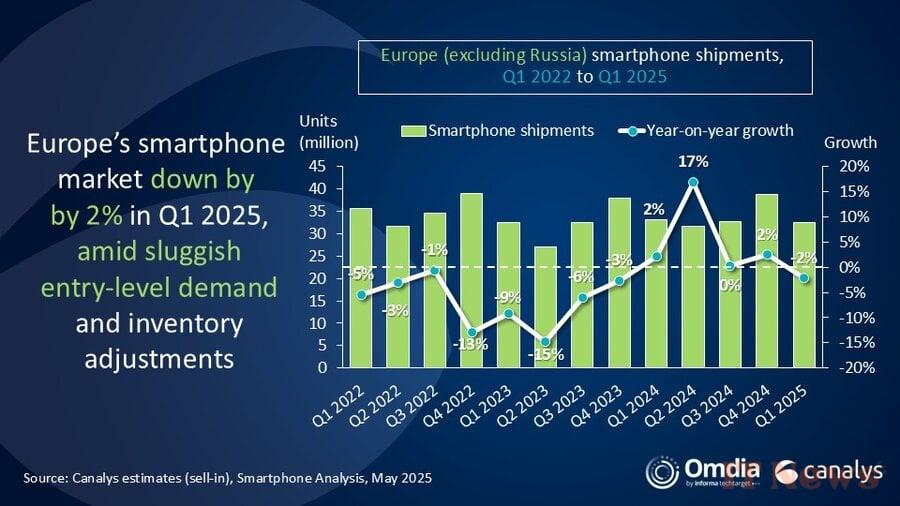

If you're one of the lucky ones heading into a long weekend and just can't wait to enjoy it, here's the gist: overall smartphone sales fell by 2%. But as is often the case, it's the details that tell the most.

High-end smartphones are growing in Europe

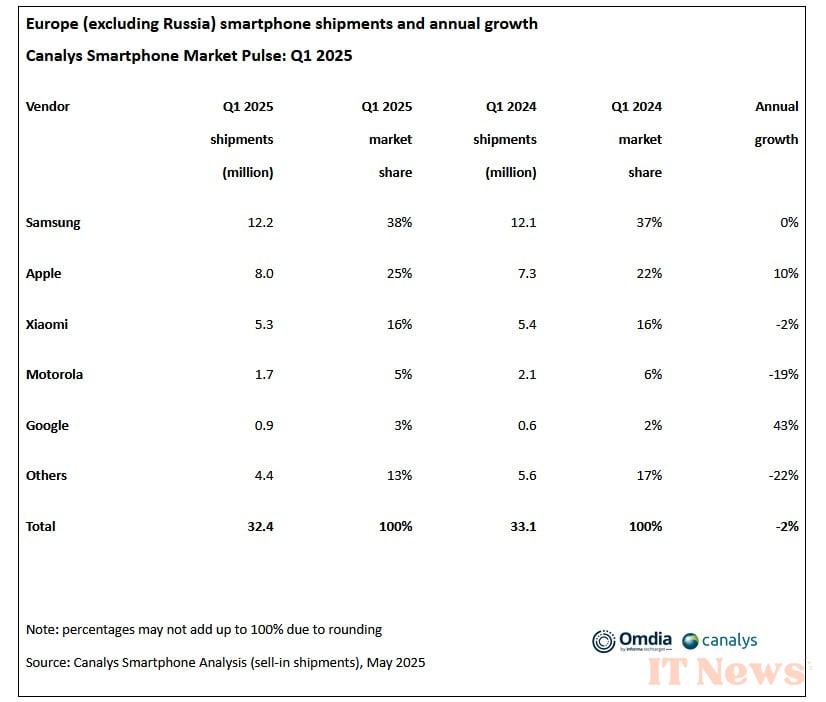

Analysts indicate that 32.4 million units were sold during the quarter. This contingent was 33.1 million at the same time in 2024. A slight year-on-year decline, therefore.

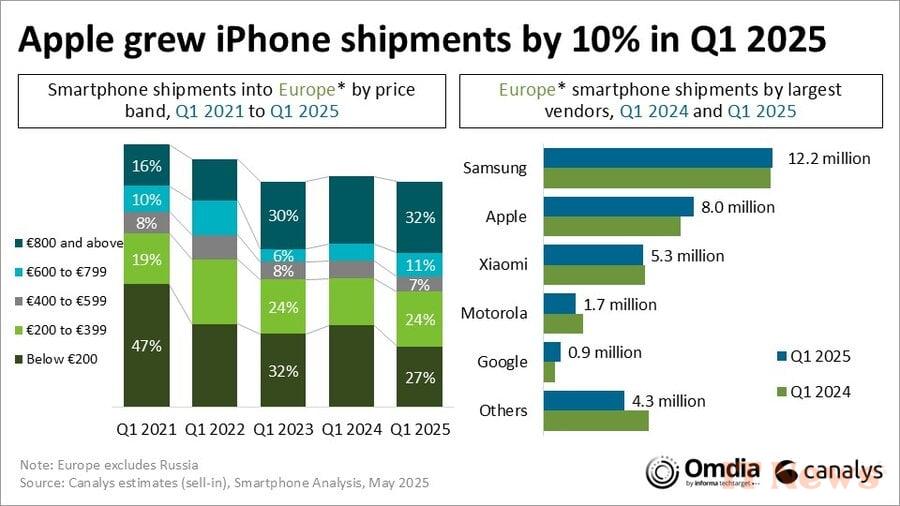

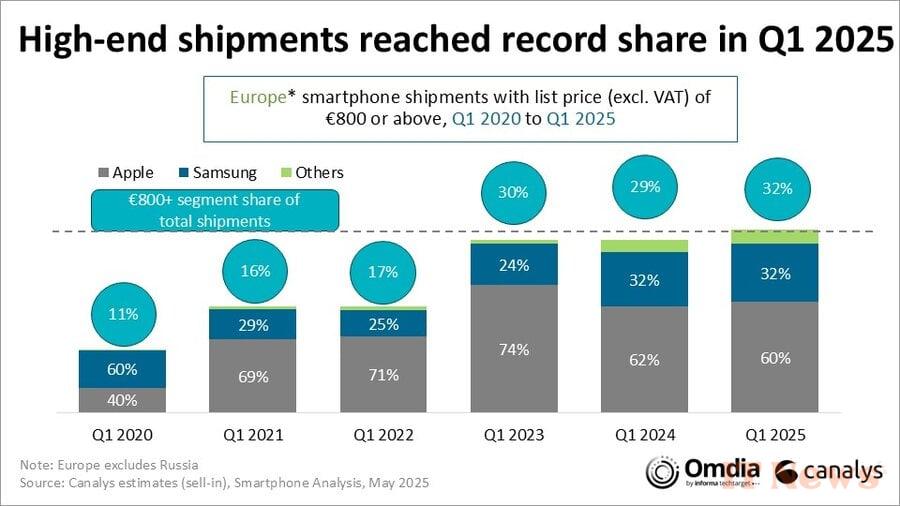

What is catching the eye, however, is the growth of high-end smartphones (over 800 euros), whose share is up compared to the first four previous years. Of the five price ranges defined by Canalys—less than €200, €200 to €399, €400 to €599, €600 to €799, and more than €800—it is the latter that has the most sales.

That said, grouping all models over €800 into a single category has some limitations. It would probably be relevant to distinguish those sold around 800/1000 euros from ultra-premium models at 1500 euros and more such as the iPhone 16 Pro Max or Samsung Galaxy S25 Ultra (let's not even talk about the Galaxy Z Fold 6 and others), as the gap in budget, and certainly in perceived value, remains significant.

The second bracket is also to be found at the other end of the spectrum. On the side of models at less than 200 euros, which represent 27% of the market. Combining the two most accessible segments (less than 400€), more than one in two smartphones (51%) sold in the first quarter of 2025 belongs to this category. In other words, more than one in two Europeans spends less than 400 euros for a smartphone.

Apple reigns supreme in the high-end segment, Samsung in the entire market

In the very high-end segment, two companies share the lion's share. These are, of course, Apple and Samsung. The former takes the largest share: its models represent 60% of sales over 800€, compared to 32% for the Korean giant. The other manufacturers share the remaining 8%.

The Korean company nevertheless has some consolation, as it dominates overall sales, all segments combined. With 12.2 million smartphones sold in the first quarter of 2025, the brand has a 38% market share in Europe. It is thus far ahead of Apple (8 million units). Incidentally, these results confirm the strength of the Samsung range on all price fronts.

Source: Canalys

0 Comments