Last year, a new French crypto company emerged. Called Deblock, it presents itself as the first French bank "that also accepts your cryptos". Approved by the French Financial Markets Authority (AMF) and holding MiCA (Markets in Crypto-Assets) accreditation, it is the work of three former employees of the neobank Revolut, Jean Meyer, Adriana Restrepo, and Aaron Beck, and a former Ledger employee, Mario Eguiluz.

What are the differences with Binance, Coinbase, and other exchanges?

Deblock should not be compared to a cryptocurrency exchange platform, such as Binance, Coinbase, or Bitpanda. As Claire Balva, Deblock's vice-president of strategy, explained to us, the offer is above all that of a bank:

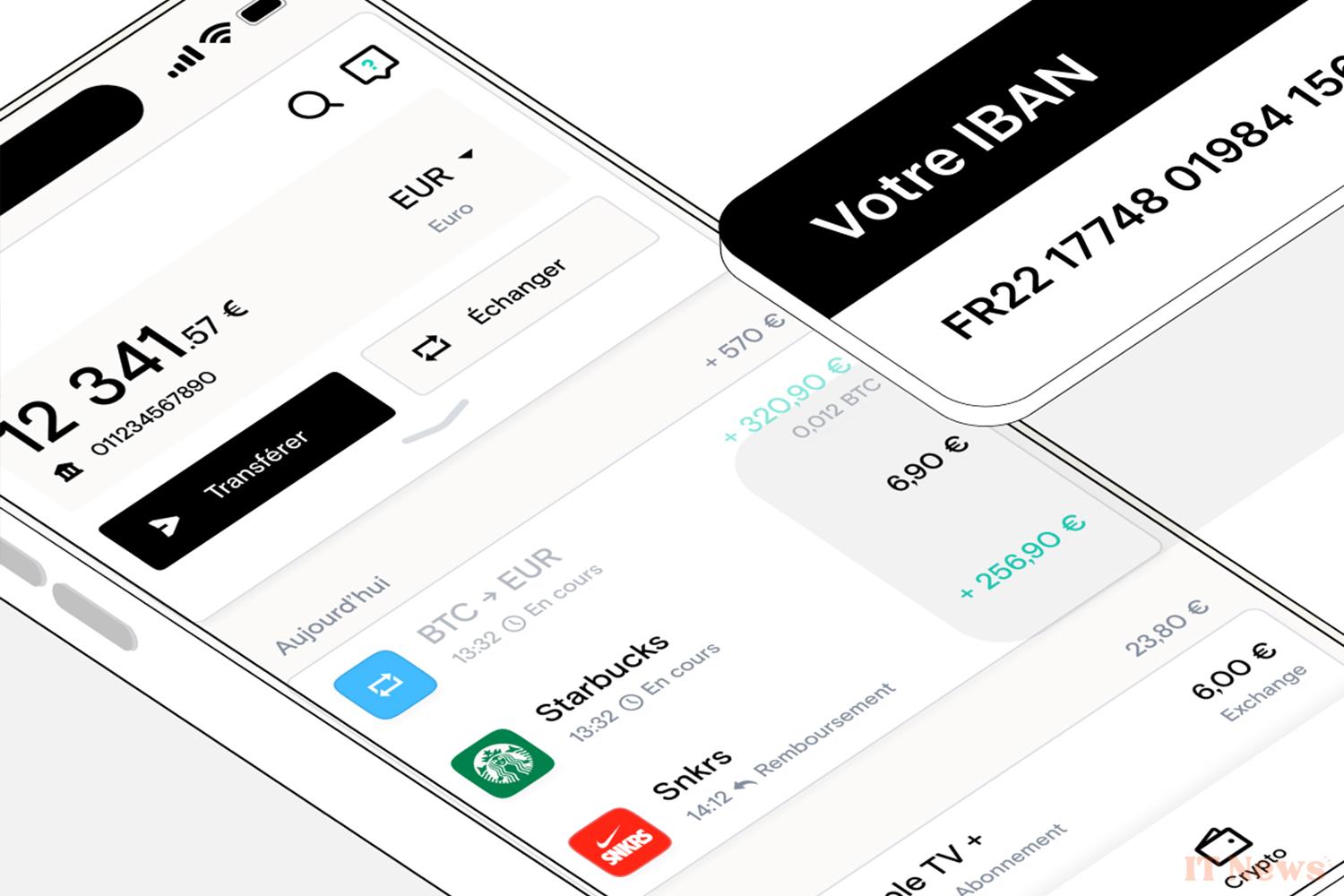

With the Deblock application, available on Android and iOS, you will be able to pay for your purchases or your rent with euros or cryptocurrencies. You can also receive your salary through your Deblock account, just like with your traditional bank account.

Deblock also stands out by offering a "self custody" service. The company lets its users keep their own digital assets, a bit like the French unicorn Ledger, which became famous with its hardware wallet. Deblock is true to the popular adage of cryptocurrency enthusiasts: "not your key, not your coins."

On the platform's official website, you can read that your cryptocurrencies will remain accessible "even if Deblock were to disappear." Unlike Binance or Coinbase, Deblock does not hold your assets in your name. You hold your holdings. In this respect, Deblock stands out from both exchange platforms and banks.

What's the difference with Ledger?

However, Deblock has a different approach from Ledger. It is a bank that allows the use of cryptocurrencies and fiat currencies, such as the euro, but it does not focus on securing cryptocurrencies, which is Ledger's core business.

Deblock is therefore not an alternative to Ledger. For Claire Balva, Deblock represents "a fairly complementary use," which does not exclude the possibility of storing cryptocurrencies on a blockchain address secured by a hardware wallet like those sold by Ledger: Deblock is more like Revolut or N26, two neobanks that have been offering cryptocurrency purchases and conversions for several years. However, these two banks do not allow users to hold their own private keys. Like exchanges, banks store your cryptocurrencies on your behalf. They therefore act as a trusted third party. You must trust an entity to handle your assets. You depend on the security and integrity of banks to access your funds.

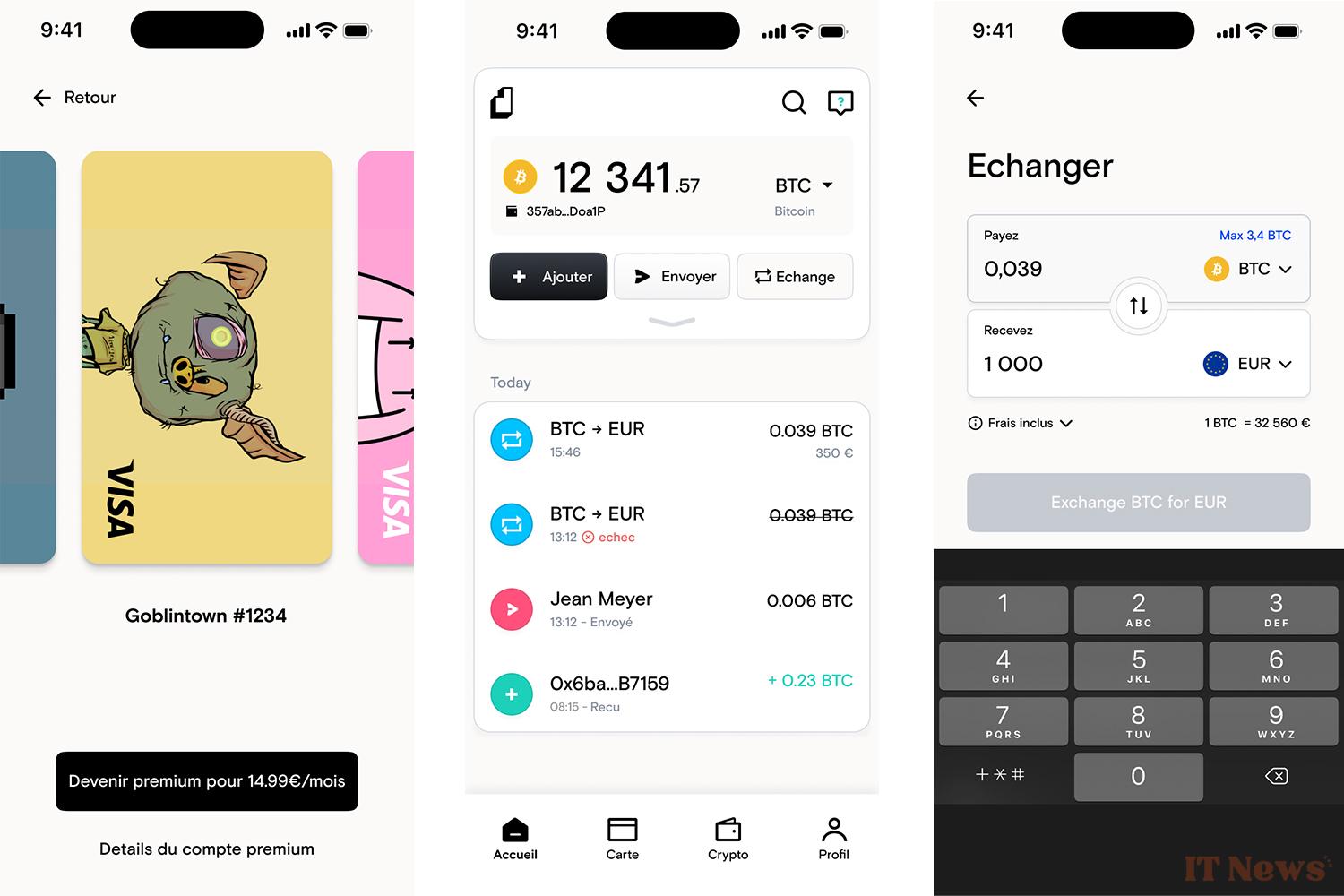

Among Deblock's competitors, there are also "non-custodial" crypto wallets, such as Metamask, adds Claire Balva. Nevertheless, the bank "is much more geared towards beginners" and towards "people who don't want a complicated user experience", believes the strategy director. She finds the wallet experience "quite unmanageable" for beginners. When opening a wallet, you have to determine a 12-word or 24-word phrase that will serve to protect your crypto. This sequence of words must be written down on paper, or recorded somewhere, to be re-encoded in the next step. Unfortunately, many budding investors give up at this stage.

Conversely, Deblock wants to "offer a user experience where the person has their own keys, but where they don't have to go through a complicated process to manage them." Ease of use is essential for Deblock. The application interface is also designed to be minimalist, clean, and intuitive.

A bank account to pay in crypto… but for what purpose?

With a Deblock account, you can easily use your digital currencies to pay for all your everyday purchases. You can buy your bread, your metro ticket, or your new car by drawing on your cryptocurrency reserves. On paper, it's as simple as paying with good old euros.

Indeed, when you pay for a good or service with your cryptocurrencies, Deblock will automatically convert the necessary amount into euros. Crypto platforms linked to a bank card, such as Bitpanda or Crypto.com, also do this. This invisible but inevitable operation will trigger "a tax event". In short, the French government will demand 30% of any profits made during the conversion, which is obviously not attractive from an economic point of view. The tax system provides for a tax of one-third of the capital gain on all sales. This is the famous flat tax.

Ultimately, Deblock expects users to continue paying for their purchases with euros. That's why the "challenge" is to have "a real current account in euros that works well, that you can use on a daily basis". This account is what sets Deblock apart from Crypto.com, Coinbase, or Bitpanda, which don't have a banking service.

Ultimately, the advantage of Deblock's approach is that it allows for an easy, smooth, and efficient transition between a traditional bank account, denominated in euros, and the world of cryptocurrencies. This bridge between the two worlds should help you easily repatriate gains made on the crypto market to your account, where you can spend your assets.

All about Deblock's offers

Deblock is built around a rather comprehensive offering. The neobank offers three different subscriptions, starting with a 100% free offer. Then there's a premium account, at €14.99 per month, which allows you to personalize your bank card with your own NFTs, earn 1% cashback, and reduce fees for buying and selling cryptocurrencies. Finally, Deblock highlights the Native offer. To take advantage of this, you must hold one of Deblock's official NFTs, minted on the Ethereum blockchain and available for sale on OpenSea. This offer further reduces the fees.

Paid offers also allow you to benefit from better rates for Deblock's savings vaults. The bank allows you to earn interest on currencies stored in virtual vaults. With the standard offer, you earn 1.52% per year on your euros and 3.12% on your euros. With a premium package, the rates climb to 5.62% for dollars and 2.74% for euros, respectively. With USDC deposits, you can climb to 6% per year. You can invest from one euro, and you can withdraw the money whenever you want. The currencies are not locked in, as is often the case in decentralized finance.

To attract new customers, Deblock has also launched the first LED metal card, presumably to compete with the high-end offerings from Revolut and others. Reserved for Premium members, it features a luminous logo that lights up with each transaction, without the need for a battery. It is available for pre-order.

0 Comments